In our drive to constantly improve your experience here at MCCA, our ongoing Customer First Initiative, launched in 2020, addressed key issues within our customer service charter. These are the results and improvements MCCA have implemented since its launch. We’re proud to share the outcomes of what was a significant project with you and how it assisted MCCA in aligning to a customer-centric model.

Providing trustworthy, affordable and high-quality shariah-compliant finance products and services to our valued customers is at the heart of MCCA’s mission.

Our aim at MCCA is to always give our customers a quality one-stop, end-to-end customer experience from the moment they first apply for our products and services. As the premium provider of Shariah-compliant finance and investment services in Australia, we have long felt that it is our duty to equip our community with the best-trained staff who are prompt in addressing their needs and meeting their service expectations.

Over the past 12 months, we’re proud to have been able to listen to and collate the feedback of more than 12,000 customers since the launch of our Customer First Initiative. Through consistently answering this feedback and preparing for future improvements, we hope to uphold our reputation as one of the highest-scoring financial institutions in Australia.

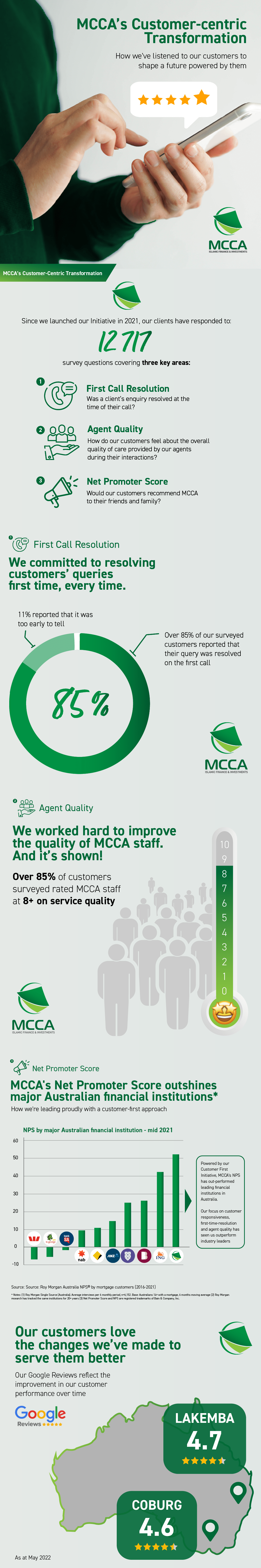

Since implementing the post-call survey, in particular over the past 12 months, we’ve been able to analyse and act on 12,717 survey responses from our customers in three key areas: first call resolution, agent quality and net promoter score. In receiving such incredible results, we’re delighted to share them with you.

Firstly, our first call resolution feedback shows that resolving our customers’ has become our priority. Over 85% of our surveyed customers reported that their query was solved on the first call, with less than 15% responding otherwise, within which 11% stated it was too early to tell.

Secondly, our agent quality proves that our customer satisfaction results speak for themselves. Over 85% of customers surveyed rated MCCA staff an 8 or above on service quality – a mark of our ongoing aim to improve the quality of our staff.

Thirdly, and most pleasingly, our Net Promoter Score (NPS) score outperforms even leading financial institutions in Australia. With an NPS of 53.27, well above the scores achieved by major banks reported within the Roy Morgan Australia NPS by mortgage customers (2016-2021) report. Our focus on customer responsiveness, first-time resolution and agent quality especially has allowed MCCA to rise as an emerging industry leader in the finance sector.

Lastly, but certainly not least, through the changes we’ve made via our customer-first approach, our Google reviews reflect the improvement in our customer satisfaction over time. Both our Lakemba (Sydney) and Coburg (Melbourne) locations see a 4.5-star + majority rating across 244 reviews – a testament to the changes we made from our customers’ incredible and valued feedback.

As MCCA continues to take our performance to new heights, customer service and satisfaction will remain at the core of our mission and a huge priority for our entire team. For customer service that is always evolving and finding ways to better serve your needs, contact MCCA today.