Announcing Our Bachar Houli Foundation Partnership

Coming together for the future of our youth

MCCA Partners with the Bachar Houli Foundation

On 7 July 2022, the Bachar Houli Foundation and MCCA announced an exciting new partnership.

Over the past 33 years, MCCA Islamic Finance & Investments has been the largest provider of Islamic finance and investments to the Australian Muslim community, helping households, businesses and societies to achieve their financial goals in line with their spiritual values.

MCCA has long supported the Bachar Houli Foundation, with the new community partnership set to extend the relationship and support the development of more role models in the Islamic community.

Securing our youth's future on multiple fronts

A visionary partnership with the leading Bachar Houli Foundation

Building on our legacy of giving back to the community

Bachar Houli (Founder of the Bachar Houli Foundation) said that MCCA’s support goes to the heart of the Foundation’s work of supporting young Islamic people.

Br Bachar shared that “We are delighted to have MCCA as part of the Bachar Houli Foundation family and look forward to working together to help Islamic youth thrive. Our programs have a touch point of over 35,000 young Islamic people, and partners like MCCA will help us continue to grow this work and our unique focus around social inclusion, leadership, and identity.”

MCCA’s Business Development Manager Adam El Zanaty added that MCCA had a strong track record and commitment to giving back to the community.

The three-year commitment will see the two organisations collaboratively nurture and develop future opportunities for young Australian Muslims.

Powering Our Youth’s Future:

A Long-standing MCCA Commitment

Powering the future of our youth is something MCCA has been committed to throughout our history.

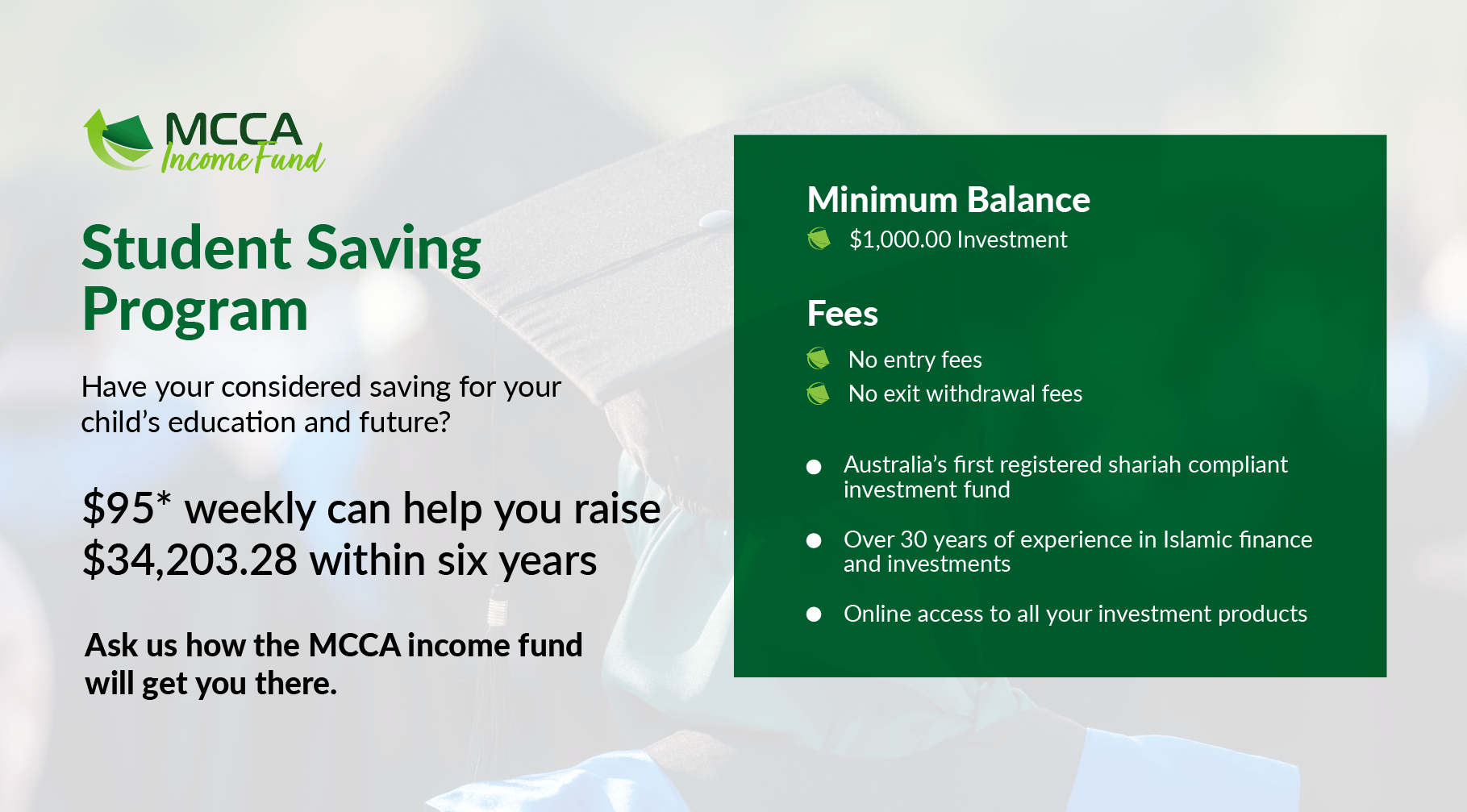

Our partnership with the Bachar Houli Foundation is one such example. Another is our Students Saving Program: a community institution that has allowed parents to invest in – and work towards – their childrens’ future.

By investing in the MCCA Income Fund, we’ve enabled parents to save towards their children’s education.

The MCCA Income Fund: Powering Our Community’s Future

The Student Saving Program is powered by our Income Fund, Australia’s first Shariah compliant registered retail mortgage fund.

The MCCA Income Fund is Australia’s leading investment option for Muslims looking to grow their wealth through Shariah compliant and strong investment options.

Proud track record

First offered in 2009 and has continually paid returns on a monthly basis since.

Independent Shariah certification

A Shariah compliant income investment product certified by MCCA’s independent Shariah Advisors.

Asset class spread

Investments are spread over many property types, providing diversification for your investment portfolio.

Regulated

The fund is a regulated retail managed investment scheme and operates under an Australian Financial Services License.

Independently audited

Performance and compliance is independently audited every 6 months by an established (Big 4) audit firm.

Competitive returns

As a low-medium risk investment product, the Fund has consistently outperformed its benchmark (Bloomberg AusBond Bank Bill Index).

In their words: Why Our Members Chose the MCCA Income Fund

Invest in our Community’s Future

Strong investment outcomes in line with your Islamic values are possible. Choose the Islamic Fund that has a strong track record and helps build our community and youth’s future.